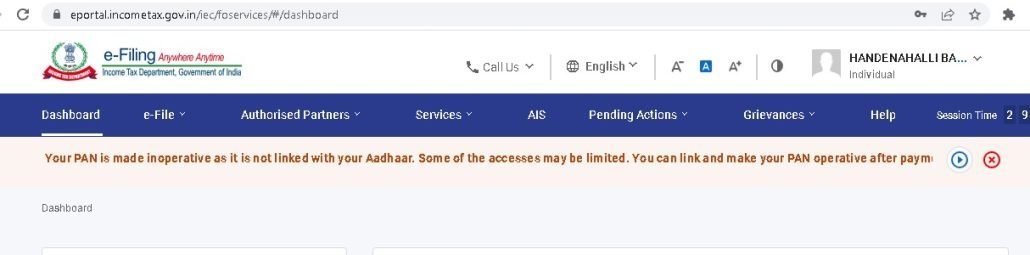

Your PAN is made inoperative as it is not linked with your Aadhaar. Some of the accesses may be limited. You can link and make your PAN operative after payment of requisite fees u/s 234H.

Forgot to link your pan and Aadhar ??? if you login to your income tax e-filing account you can see this message.

The Pan can be made active by linking your aadhar and Pan online by paying Rs.1000.00 late fees and linking both online. Till you make it operative what you do ? and What you cannot ?

It is clarified that an inoperative PAN is not an inactive PAN. One may file the Income Tax Return (ITR), irrespective of PAN becoming inoperative. Only following are the consequences of ‘inoperative’ PAN

i. Pending refunds and interest on such refunds will not be issued to inoperative PANs.

ii. TDS will be required to be deducted at a higher rate for inoperative PANs in accordance with section 206AA.

iii. TCS will be required to be collected at a higher rate for inoperative PANs in accordance with section 206CC.