Knowinfonow – Finance, Tax & Compliance Update

Is Service Tax Applicable on Google Ads? Here’s the Latest Position Under GST

Confused about tax on Google Ads? Understand how GST replaced service tax and…

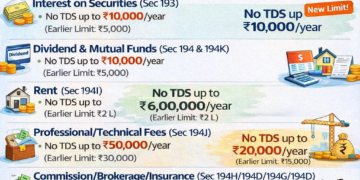

TDS Updates FY 2025-26 – What Every Taxpayer, Landlord & Business Must Know (Effective 1 April 2025)

The Government of India has introduced major changes in TDS (Tax Deducted at…

Arround the World

Know your VAT Jurisdiction in Karnataka State- Bangalore

PIN CODE WISE LVOs in BENGALURU: This will be very useful for registering in GST…

Income Tax

Trending

Latest Post

MCA Compliance Scheme 2026 (CCFS-2026): One-Time Opportunity for Companies to Clear Pending Filings at Massive Discount

The Ministry of Corporate Affairs (MCA) has introduced the MCA Compliance Scheme 2026 (CCFS-2026), a powerful one-time relief initiative designed to help companies regularize their compliance status at significantly reduced…

India’s Income-Tax Reset: What the New Budget Really Changes for Taxpayers

India’s latest Union Budget signals one of the most far-reaching income-tax overhauls in decades. Beyond rate changes or exemptions, the government has chosen a deeper reset—rewriting the law itself, redesigning compliance,…

India–EU Trade Deal: What Will Get Cheaper for Indians if the “Mother of All Deals” Becomes Reality?

In recent days, a widely shared image and headline have sparked intense discussion across social media and news platforms: India and the European Union announcing what is being called the “mother of all trade deals.” If the…

Dividend not received? | IPO refund pending ? | Investors helpline from SEBIDividend Not Received? Here’s SEBI’s Toll-Free Helpline for InvestorsDividend not received? | IPO refund pending ? | Investors helpline from SEBI

Not received your dividend? SEBI’s toll-free investor helpline helps with dividend issues, complaints, demat queries and SCORES tracking across India.

Is Service Tax Applicable on Google Ads? Here’s the Latest Position Under GST

Confused about tax on Google Ads? Understand how GST replaced service tax and when RCM applies for online advertising services.

TDS Updates FY 2025-26 – What Every Taxpayer, Landlord & Business Must Know (Effective 1 April 2025)

The Government of India has introduced major changes in TDS (Tax Deducted at Source) provisions for FY 2025-26, effective from 1 April 2025. These changes increase exemption limits under multiple sections of the Income Tax…

New Wage Code India 2020: Decoding the Payroll & HR Transformation

India's labour law ecosystem is on the brink of its most significant transformation in decades. The Code on Wages, 2019, popularly known as the New Wage Code 2020, is a monumental legislative reform designed to…

Understanding the Karnataka Micro Loan and Small Loan (Prevention of Coercive Actions) Ordinance, 2025: Borrower Rights & Lender Obligations

Introduction The Karnataka Micro Loan and Small Loan (Prevention of Coercive Actions) Ordinance, 2025 was introduced by the Government of Karnataka to safeguard economically vulnerable individuals—particularly farmers, women,…

Advertising Norms for CA Firms: What the 2025 ICAI Revisions Mean for Your Firm

Introduction The ICAI has long held one of the most conservative positions in professional services marketing: under the Chartered Accountants Act, 1949, clauses (6) & (7) of the First Schedule bar solicitation and…

Checklist for Accountants: Update Your GST Systems & HSN/SAC Codes Post-Reform

🧾 Introduction: GST Reform 2025 and What It Means The GST 2.0 reforms, effective from September 2025, have brought in major structural changes — including revised HSN (Harmonized System of Nomenclature) and SAC (Service…