Tag: GST return filing

Checklist for Accountants: Update Your GST Systems…

🧾 Introduction: GST Reform 2025 and What It Means The GST 2.0 reforms, effective from September…

Compliance calendar for the month of January, 2022

Starting, owning, or doing a business in India comes with important compliance that a business…

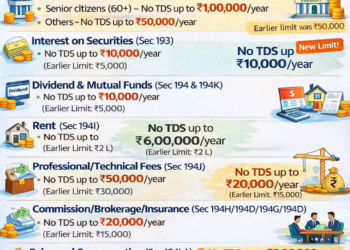

Direct taxes v/s Indirect taxes in India

Difference between Direct Tax and Indirect Tax in India Introduction In India, the government’s…

Compliance calendar for the month of October 2021

And finally the world seems to be recovering from COVID 19 effects. Things, including businesses are…

Non submitting the bank Details lead to GST…

As per Rule 10A of the Central Goods and Services Tax Rule 2017, it is mandatory to furnish the bank…

GST cancelled looking to restore back ?? here is the…

No Late fee on GSTR-3B for NIL Tax Liability: For all those who have no tax liability but have not…

New GST return format – Here is what you should know…

Recently, the Government of India has introduced 3 new GST Return forms for businesses having GST…

What is HSN code and where to find it

HSN or Harmonized System of Nomenclature is a 6 digit uniform code system was developed by the World…

How to prepare GSTR 2 ?

Most of us have already filed GSTR3B and GSTR1 even we have Nil income Nil return need to be filed .…

GST changes and Update from GST council meet good news…

DECISION TAKEN IN 22ND GST COUNCIL MEETING: 1. Composition Scheme Limit enhanced to Rs. 1.00 Cr with…