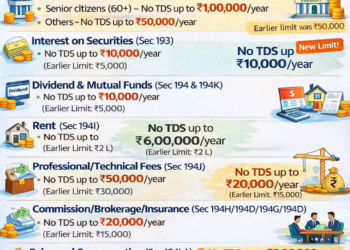

Section Income type Threshold limit Individual/HUF TDS Rate in % 192 Salary Income Income Tax Slab Slab Rates 192A EPF-Premature Withdrawal Rs 50000 10% If no PAN, then TDS @ 30% 193 Interest on Securities Rs 10000 (On Security of Central or State Govt ) 10% 194 Dividend to Shareholders Rs 5000 10% 194K Dividend by Mutual Fund Companies Rs 5000 10% 194A Interest other than on Seucurities by Bank/Post Office (Like FDs) Rs 40000 (For Senior Citizens Rs 50000 10% 194B Winning from Lotteries/Puzzle/Game Rs 10000 30% 194BB Winning from Horse Race Rs 10000 30% 194D Payment of Insurance Commission Rs 15000 5% 194DA Payment in respect of Life Insurance Policy Rs 100000 1% 194EE Payment of NSS Deposits Rs 2500 10% 194G Commission on sale of Lottery Tickets Rs 15000 5% 194H Commission or Brokerage Rs 15000 5% 194I Rent of Land, Building or Furniture Rs 240000 10% 194I Rent of plant and Machinery Rs 240000 2% 194IB Rent Rs 50000 (Per Month) 5% 194IA Transfer of immovable Property (other than Agricultural Land) Rs 50 Lakhs 1% 194LB Interest from Infra Bonds NA 5% 194LD Interest on certain Bonds and Govt. Securities NA 5%