The Government of India has introduced major changes in TDS (Tax Deducted at Source) provisions for FY 2025-26, effective from 1 April 2025. These changes increase exemption limits under multiple sections of the Income Tax Act, bringing huge relief to senior citizens, landlords, freelancers, investors and MSMEs.

If you earn interest, rent, dividends, professional fees, commission or compensation, these new rules will directly impact your tax deductions.

Revised TDS Limits for FY 2025-26

Interest Income – Section 194A

| Category | New TDS Exemption |

|---|---|

| Senior Citizens (60+) | ₹1,00,000 per year |

| Others | ₹50,000 per year |

Earlier, senior citizens had a limit of ₹50,000. This doubling significantly benefits retirees relying on FD and savings interest.

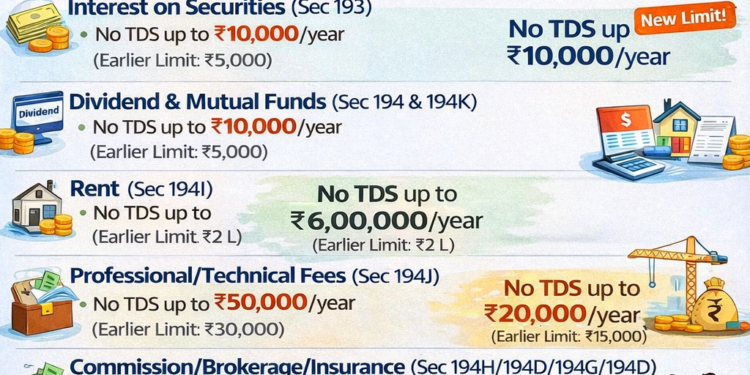

Interest on Securities – Section 193

No TDS will be deducted if the annual interest does not exceed ₹10,000

Earlier limit: ₹5,000

This benefits investors in bonds, government securities and debentures.

Dividend & Mutual Fund Income – Sections 194 & 194K

| New Limit | Earlier |

|---|---|

| ₹10,000 per year | ₹5,000 |

Retail investors and SIP holders will see fewer deductions.

Rent Income – Section 194I

| New Threshold | Earlier |

|---|---|

| ₹6,00,000 per year | ₹2,40,000 |

Now TDS applies only if rent exceeds ₹50,000 per month.

This is a massive relief for landlords.

Professional & Technical Fees – Section 194J

| New Limit | Earlier |

|---|---|

| ₹50,000 per year | ₹30,000 |

Applicable to doctors, consultants, freelancers, architects, lawyers, IT professionals etc.

Commission, Brokerage & Insurance – Sections 194H, 194D, 194G

| New Limit | Earlier |

|---|---|

| ₹20,000 per year | ₹15,000 |

Applies to agents, channel partners, brokers and insurance advisors.

Enhanced Compensation – Section 194LA

| New Limit | Earlier |

|---|---|

| ₹5,00,000 | ₹2,00,000 |

Applicable to land acquisition compensation paid by government or infrastructure agencies.

New TDS Section – Section 194T (Partner Payments)

From FY 2025-26, TDS will be applicable on payments to partners, including:

- Salary

- Remuneration

- Interest

- Bonus

- Commission

This applies to Partnership Firms and LLPs and will impact profit distribution and tax planning.

Why These TDS Changes Are Important

These updates aim to:

- Reduce unnecessary tax deductions

- Improve cash flow for individuals and businesses

- Reduce refund claims

- Encourage savings and investment

Senior citizens, property owners, freelancers and MSMEs will benefit the most.

What You Should Do Before April 2025

✔ Review rental agreements

✔ Update professional invoices

✔ Adjust partnership drawings

✔ Optimize tax planning

✔ Reconfigure accounting software

Need Expert Help?

For TDS compliance, Income Tax, GST, Audit & Legal Advisory:

🔹 KnowInfoNow – https://knowinfonow.com

🔹 CA in Bangalore – https://www.cainbangalore.com