Dear Tax Payer,

Name: ABC

PAN: ALXXXXXX3K, A.Y.: 2024-25

DIN: CPC/2425/G6a/46615553202

Kindly refer to the intimation u/s 143(1) dated 5-Aug-2024 issued in your case.

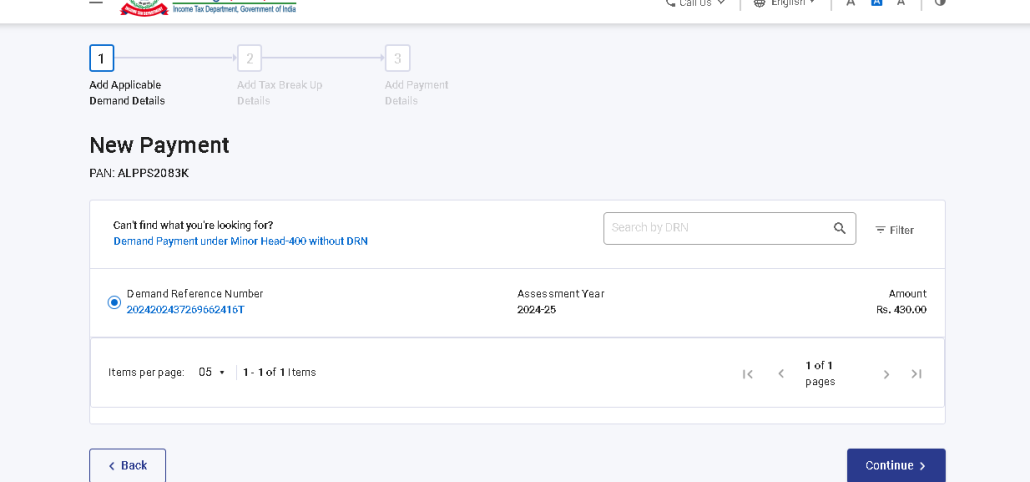

In the income-tax return filed by you for the AY 2024-25, it is seen that the details of tax payment challan have not been entered in Schedule IT. Hence, a demand was raised while processing your return. The details of demand are available in the above-mentioned intimation.

As the credit for taxes paid, if any, was not claimed in the return of income filed, you may submit a rectification request to claim the credit of taxes paid by you. The tax payment details may be furnished in Schedule of IT of the income-tax return form.

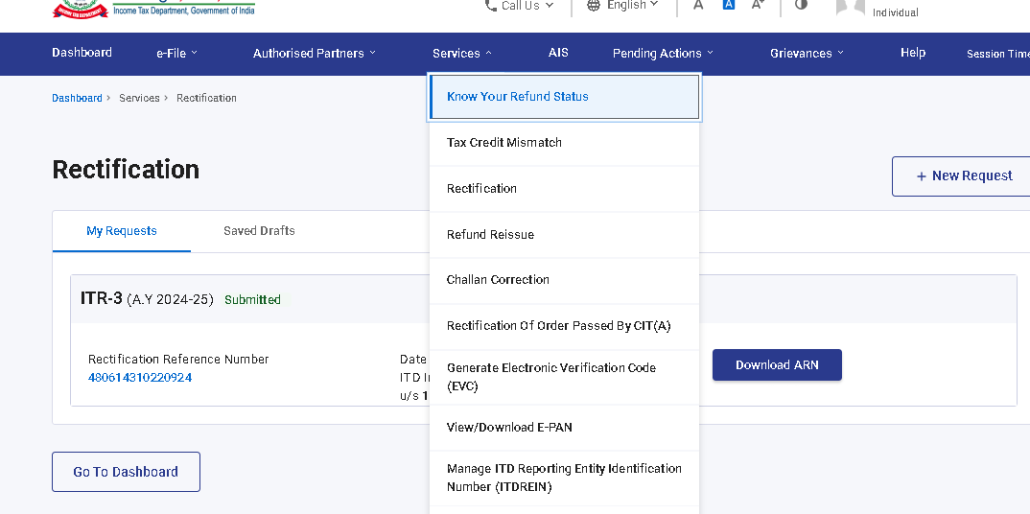

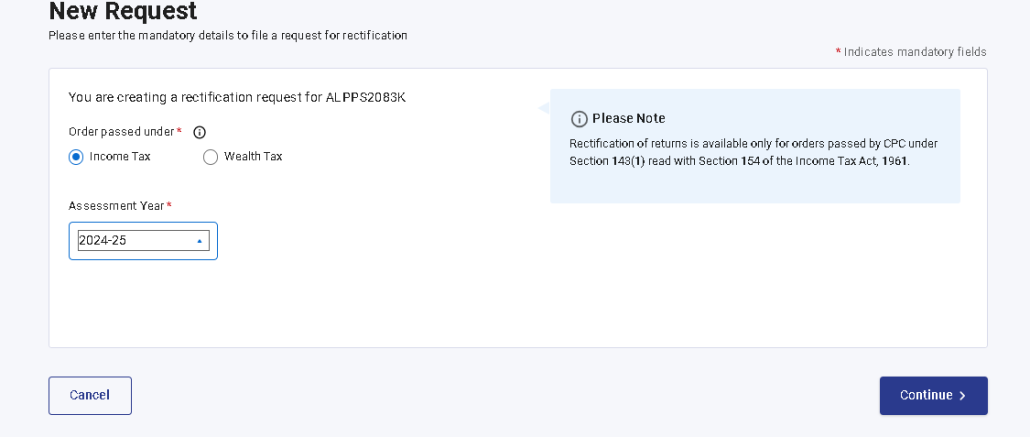

To submit a rectification request, please log in to www.incometax.gov.in using your user ID & Password. Thereafter, Click on “Services” tab >> Drop down will show “Rectification” >> Click on “Rectification” >>Click on “+New Request”

Received a demand notice for your Income Tax Return for AY 2024-25? Don’t worry! In this post, we’ll guide you through the process of responding to a tax demand. Learn how to verify the details, understand the notice, and resolve any discrepancies on the income tax portal. Stay compliant and avoid penalties by following these simple steps!

Tax payment under Tax demand notice must be paid under the head Demand Payment as Regular Assessment Tax (400)

Just by paying the demand as raised is not enough one need to apply for Rectification as well using the following method:

and enter the Tax paid details and submit to reprocess the return.