Have You Paid GST on Rent Under RCM? The Karnataka Commercial Tax Department is Watching

If you’re operating your business from a rented premises and the landlord is an unregistered person, it’s time to double-check your GST filings. Recently, the Karnataka Commercial Taxes Department has started issuing formal notices to taxpayers who failed to discharge GST liability under the Reverse Charge Mechanism (RCM) on such rent payments.

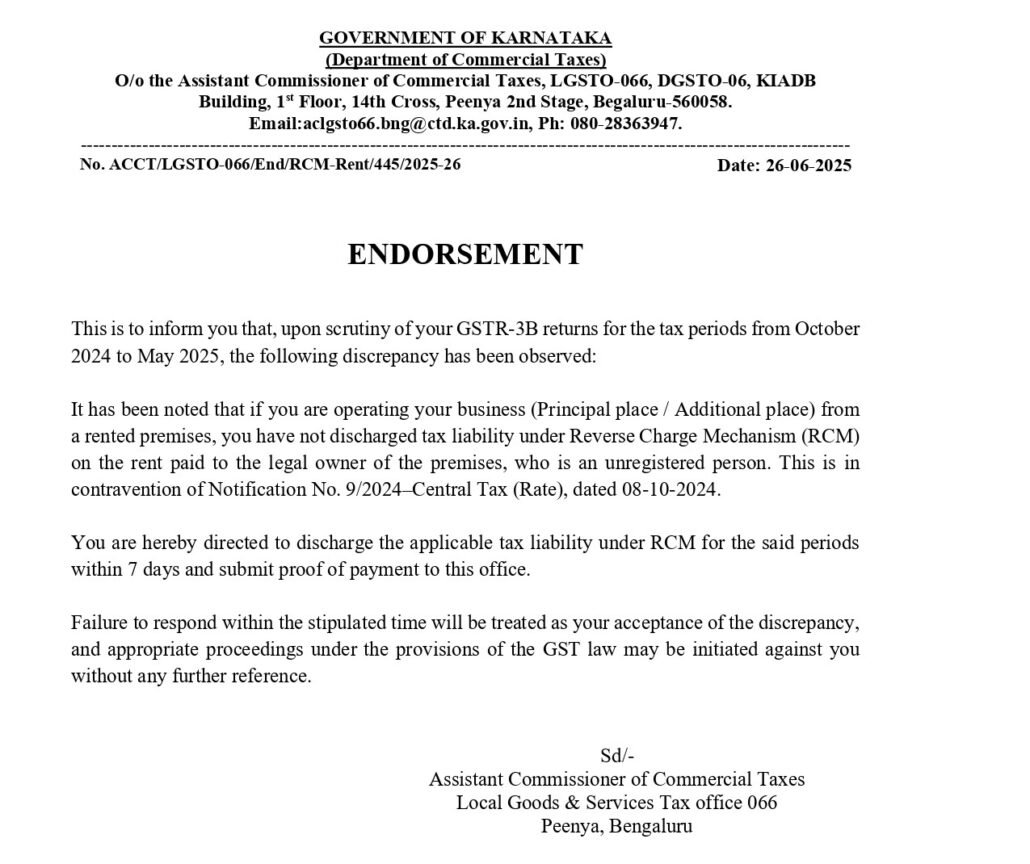

One such notice dated 26-06-2025 points out discrepancies in GSTR-3B filings from October 2024 to May 2025, citing non-payment of RCM on rent paid to unregistered landlords. This scrutiny is based on Notification No. 9/2024 – Central Tax (Rate), dated 08-10-2024.

📌 What is the Issue?

As per GST law, when a registered person rents a commercial property from an unregistered person, the responsibility to pay GST shifts from the landlord to the tenant under RCM. The tenant must pay 18% GST (9% CGST + 9% SGST) on the rent and report it in GSTR-3B.

🧾 What Does the Notice Say?

The notice clearly mentions:

- The taxpayer failed to discharge GST under RCM.

- They must now pay the applicable tax within 7 days and submit proof.

- Failure to comply will be treated as acceptance of the discrepancy, and legal action under GST provisions may follow.

✅ What Should Businesses Do?

- Review Rent Agreements – Check whether your landlord is registered under GST.

- Evaluate Past Payments – Identify if any RCM obligations were missed.

- Discharge RCM Liability – Make payment through DRC-03 if necessary.

- Maintain Proof – Submit challan and proof of compliance to the concerned tax office.

⚠️ Consequences of Ignoring the Notice

Non-compliance can lead to:

- Interest and penalties

- Audit or scrutiny

- Legal proceedings under GST law

Final Thoughts

This notice serves as a wake-up call for businesses operating from rented premises. RCM compliance is no longer being overlooked. It’s advisable to proactively assess your RCM obligations and avoid last-minute surprises.

If you’re unsure about your GST compliance or need assistance with RCM payments, reach out to a professional tax advisor or your CA.

Stay compliant. Stay informed.

📞 For GST consulting or training, contact us at 9902977233/info@gstinbangalore.com

#GSTIndia #ReverseCharge #RCMOnRent #KarnatakaGST #TaxCompliance #BusinessTax #GSTNotice