192 – Salary

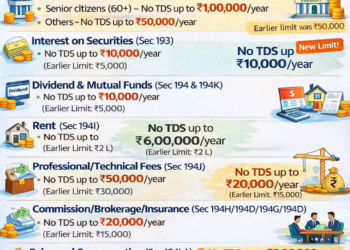

193 – Interest on Securities

194 – Dividends

194A – Interest other than ‘Interest on securities’

194B – Winning from lottery or crossword puzzle

194BB – Winning from horse race

194C – Payments to contractors and sub-contractors

194D – Insurance commission

194E – Payments to non-resident sportsmen or sports associations

194EE – Payments in respect of deposits under National Savings Scheme

194F – Payments on account of repurchase of units by Mutual Fund or Unit Trust of India

194G – Commission, price, etc., on the sale of lottery tickets

194H – Commission or brokerage

194I – Rent

194J – Fees for professional or technical services

194K – Income payable to a resident assessee in respect of units of a specified mutual fund or of the units of the Unit Trust of India

194LA – Payment of compensation on acquisition of certain immovable property

195 – Other sums payable to a non-residents

196A – Income in respect of units of non-residents

196B – Payments in respect of units to an offshore fund

196C – Income from foreign currency bonds or shares of indian company payable to non-residents

196D – Income of foreign institutional investors from securities

206CA – Collection at source from alcoholic liquor for human consumption

206CB – Collection at source from timber obtained under forest lease

206CC – Collection at source from timber obtained by any mode other than a forest lease

206CD – Collection at source from any other forest produce (not being tendu leaves)

206CE – Collection at source from any scrap

206CF – Collection at source from contractors or licensee or lease relating to parking lots

206CG – Collection at source from contractors or licensee or lease relating to toll plaza

206CH – Collection at source from contractors or licensee or lease relating to mine or quarry

206CI – Collection at source from tendu Leaves